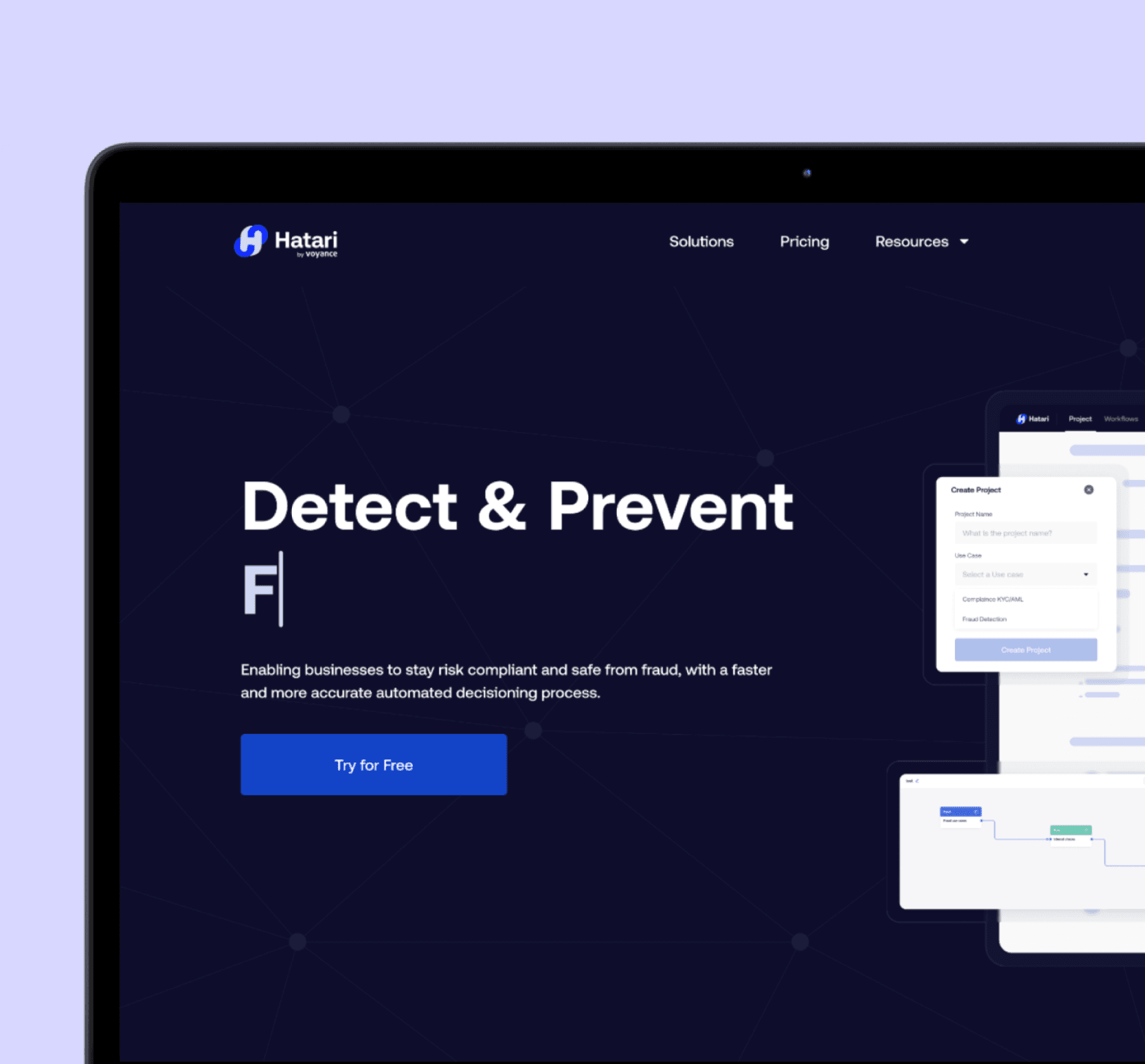

Web Application Design (2022)

I owned in its entirety the ideation, user

research, User experience design, and User interface design of the project.

Tools used

Figma

Miro

Google docs

Notion

Project duration

8 weeks

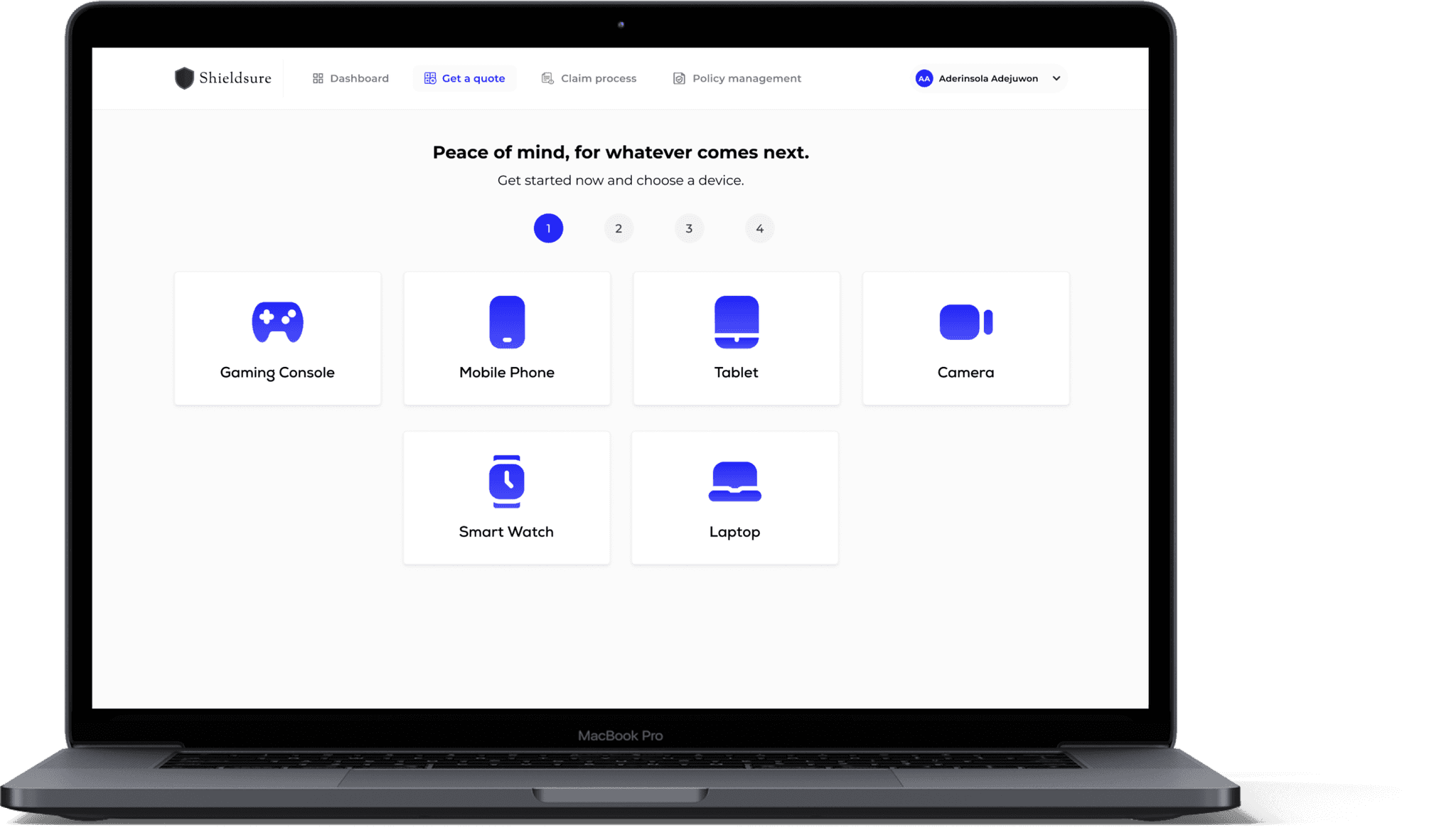

Shieldsure aims to revolutionize the insurance protection landscape and make it easier for customers to secure their personal devices.

For this project I embarked on designing a web application for Shieldsure, with the aim of making insurance protection for personal devices more accessible and user-friendly.

As the number of electronic devices in people's daily lives increases, the risk of damage, loss, or theft also increases. People are in need of a reliable and affordable solution to protect their valuable devices. However, existing insurance options are often complex, difficult to understand, and do not offer comprehensive coverage.

What I did

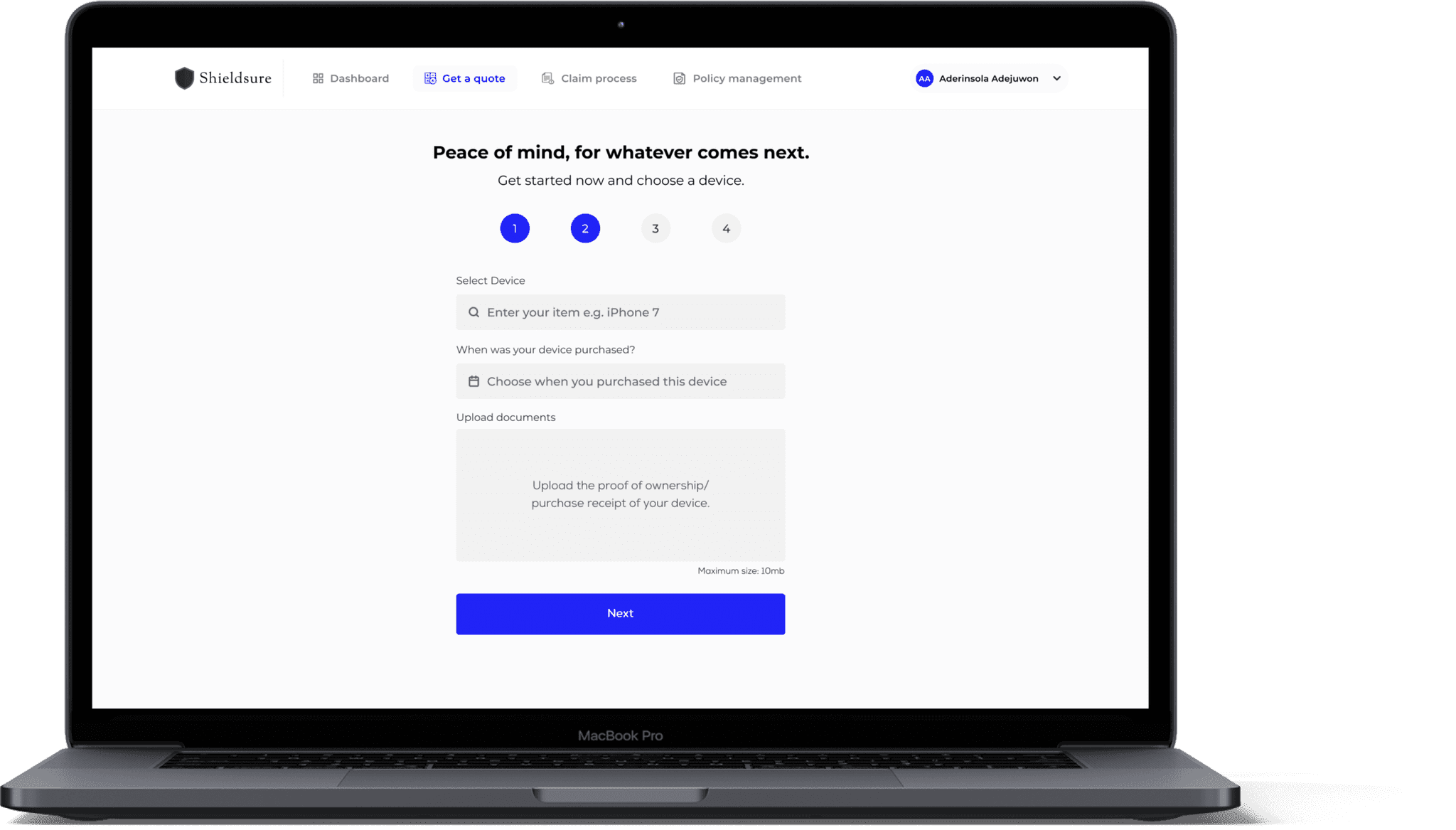

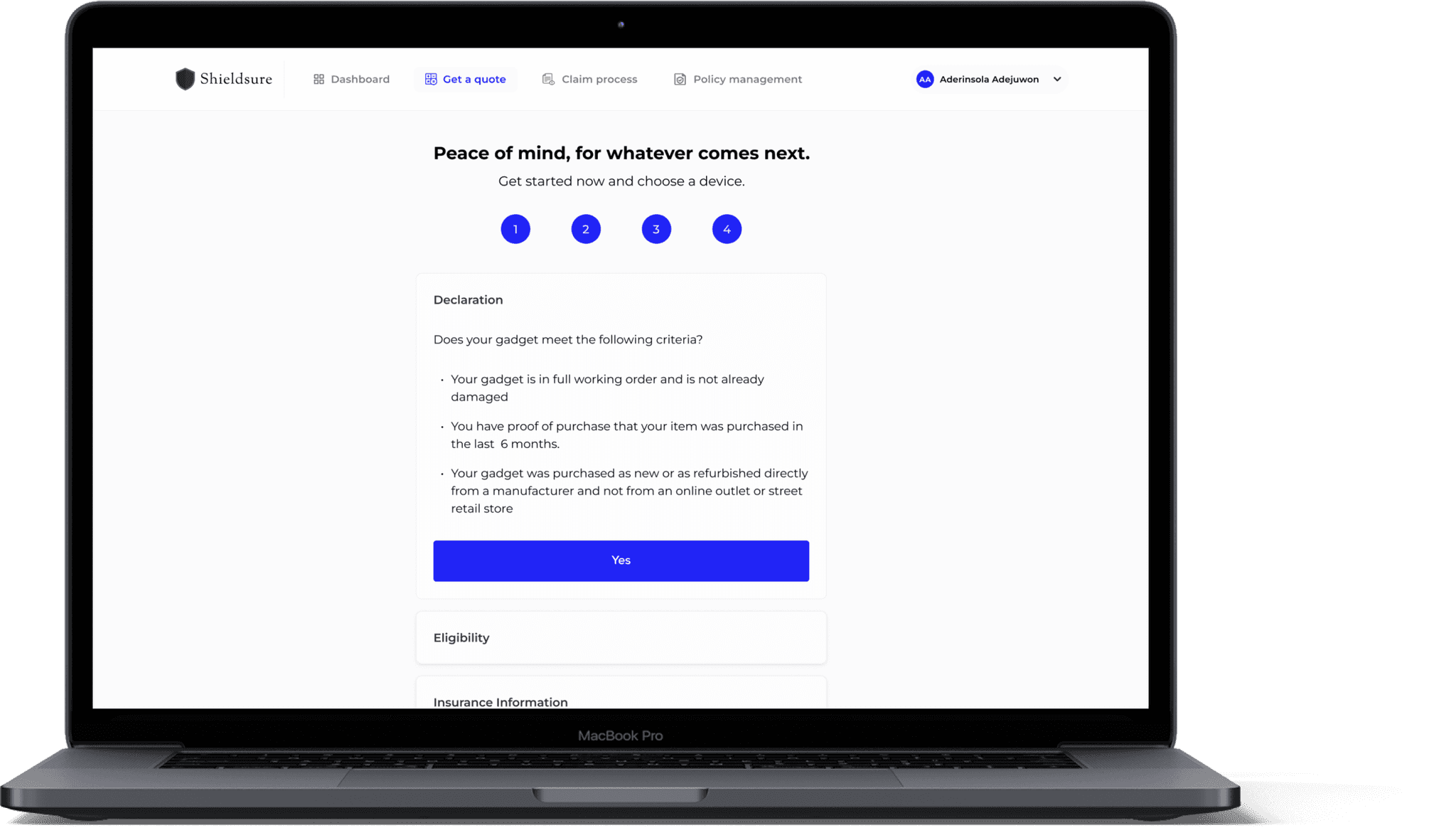

Under a 6 to 8 weeks timeline, I first focused on conducting a comprehensive competitor analysis to identify key areas for improvement in this field. I then went on to do some user research by first developing user personas and using these personas to determine the demographic of people that I needed to focus on for my user survey based on m results from all of this, I then established the user flow of the product and created high fidelity prototypes with a string emphasis on a clear and visually appealing design.

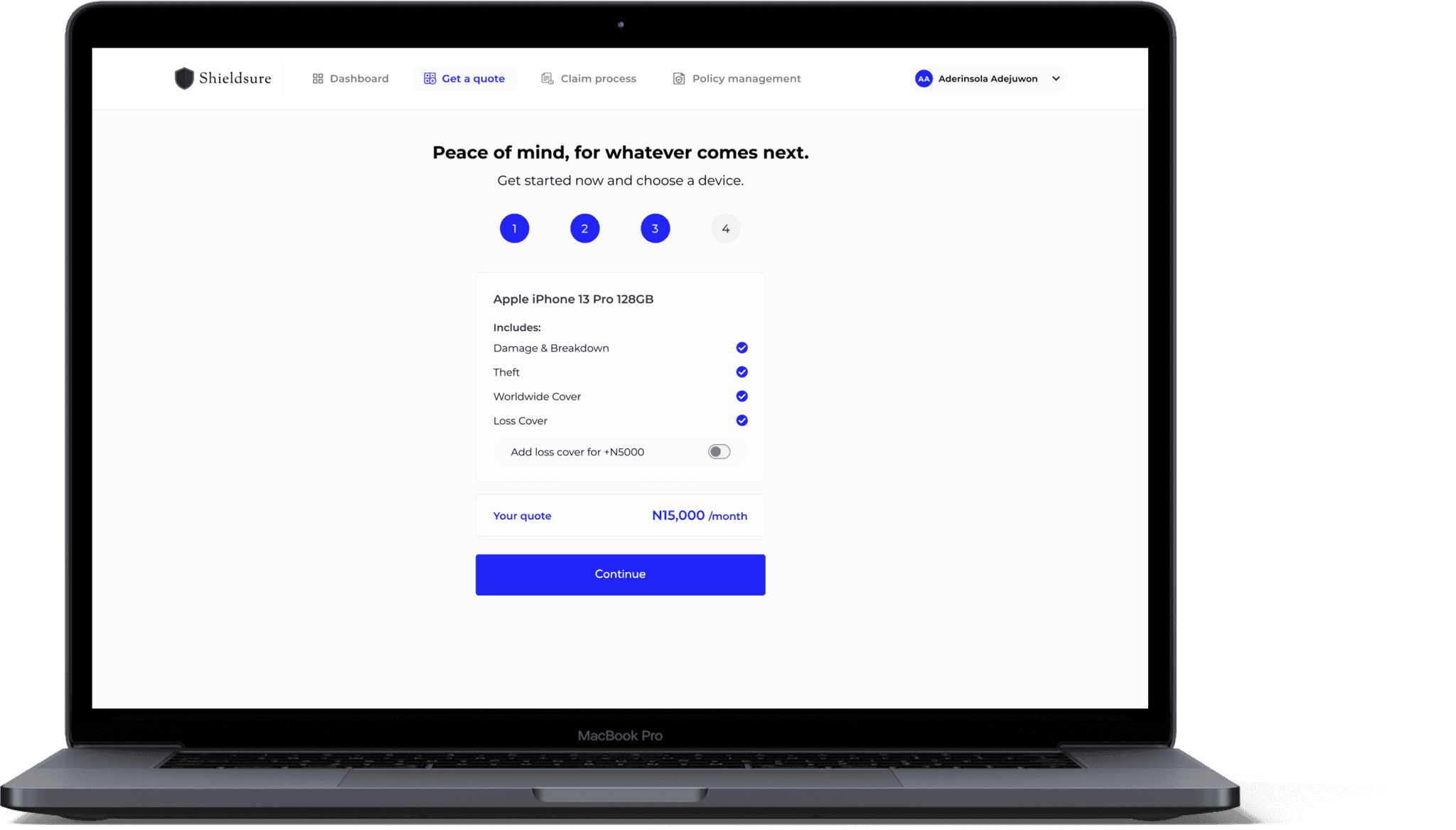

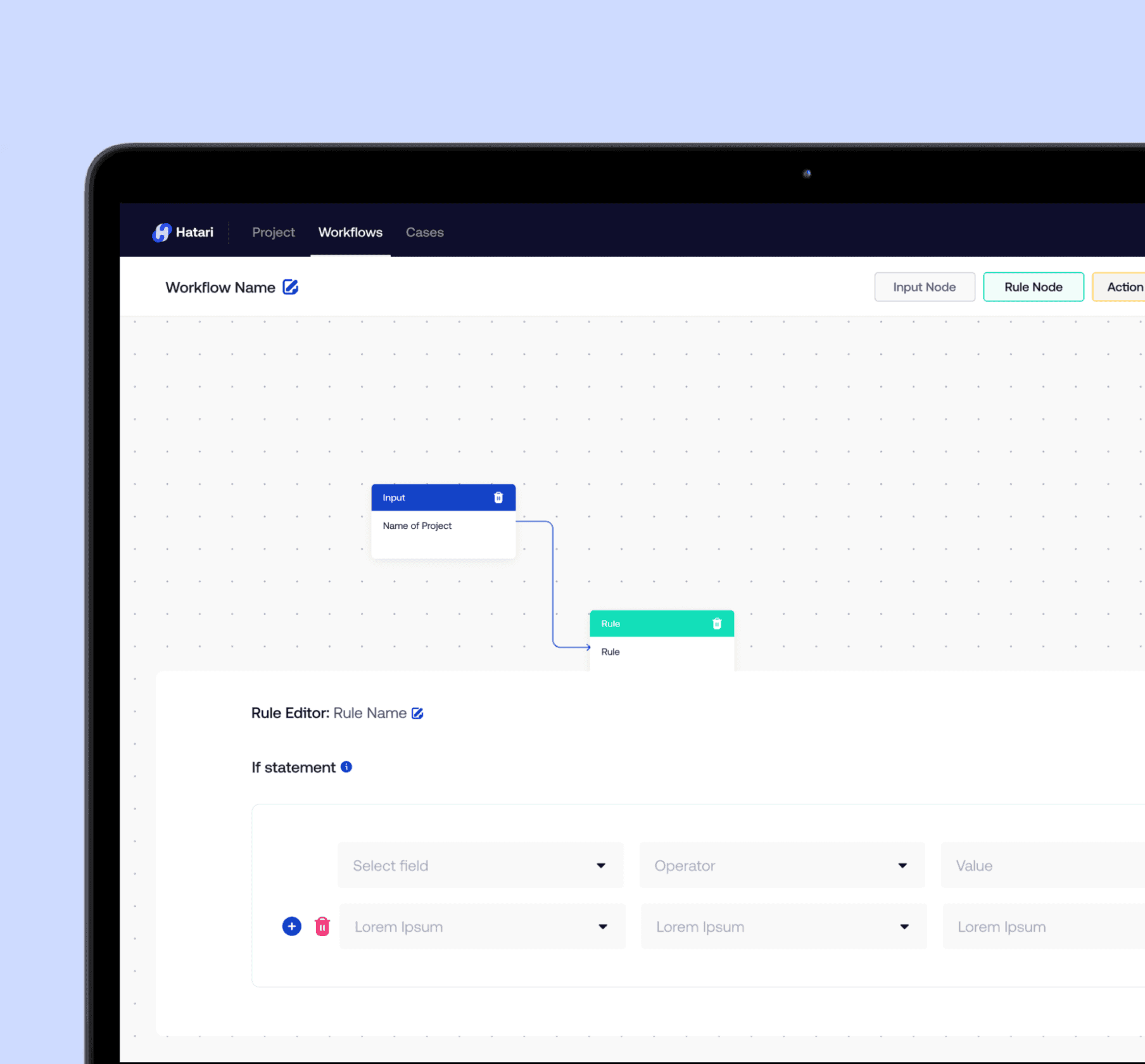

ShieldSure's unique selling point is its ability to offer customized coverage options for customers' personal devices, including phones, laptops, and cameras, based on their specific needs and preferences. The app features a dashboard that serves as a centralized hub for customers to manage their policy information, check the status of their claims, and access their policy documents. The claims process is made simple and straightforward, with a step-by-step guide to filing a claim, and the app offers seamless integration with other relevant services, such as device tracking and theft reporting.

Goals

The goal is to create a product that offers simple, transparent, and affordable insurance coverage for a wide range of devices, including smartphones, laptops, and other electronics. The company aims to provide peace of mind for customers, allowing them to enjoy their devices without worrying about the cost of repairs or replacements.

I conducted a comprehensive competitor's analysis of the device insurance industry and was able to look into 10 existing device insure products(like: Jumiapay, Jumia One, Paga Protect, Quickteller Insure, MyDevice…etc) based on this analysis I found out the following:

1.

Most competitors have limited range of coverage options and lack comprehensive coverage for other types of devices.

2.

Most of the competitors offer device insurance as part of a broader range of services or financial services

3.

A few competitors have well-established brands and user-friendly apps.

User Research

1.

Device owners(Obviously), people who own electronic devices, such as smartphones, laptops, and tablets, and are looking to protect their investments.

2.

Busy professionals, people who rely on their devices for work or personal use and cannot afford to be without them for extended periods of time especially people that work from home.

3.

Budget-conscious consumers, are people who are looking for an affordable way to protect their devices without sacrificing quality, a main example identified here was students

1.

A significant number of respondents own and use multiple devices regularly, including smartphones, laptops, tablets, and cameras.

2.

Around 50% of respondents have purchased insurance for their devices in the past, with mixed experiences. A significant portion of those who have purchased insurance reported positive experiences with fast and convenient claims processes and adequate coverage. However, others reported negative experiences with high premiums, complicated claims processes, and inadequate coverage.

3.

The majority of respondents expressed concern about the potential damage or loss of their devices, with a high level of importance placed on the cost and coverage of the insurance policy.

4.

Around 60% of respondents indicated that they are likely to purchase insurance for their devices in the future, with a preference for policies that offer affordable monthly or weekly premiums, comprehensive coverage, and fast and convenient claims processes.

5.

Respondents reported dissatisfaction with their current device protection options, with a significant portion expressing interest in purchasing insurance that covers accidental damage, theft, or loss.